The boss of Australia’s largest bank has warned that the economy is already declining and that a “short, sharp contraction” is on the way.

Late on Wednesday, the chief executive of the Commonwealth Bank of Australia, Matt Comyn, delivered the company’s annual results.

Although the CBA made an eye-watering $9.6 billion in profit over the last financial year, Mr Comyn warned that tougher times were on the horizon.

He told the Australian Financial Review that he predicted “a short, sharp contraction in the Australian economy.”

“We are definitely expecting a more challenging year ahead than we have seen in the last 12 months,” he added.

However, in some good news, the banking CEO believes a contraction is almost a certainty but a full-blown recession is less likely.

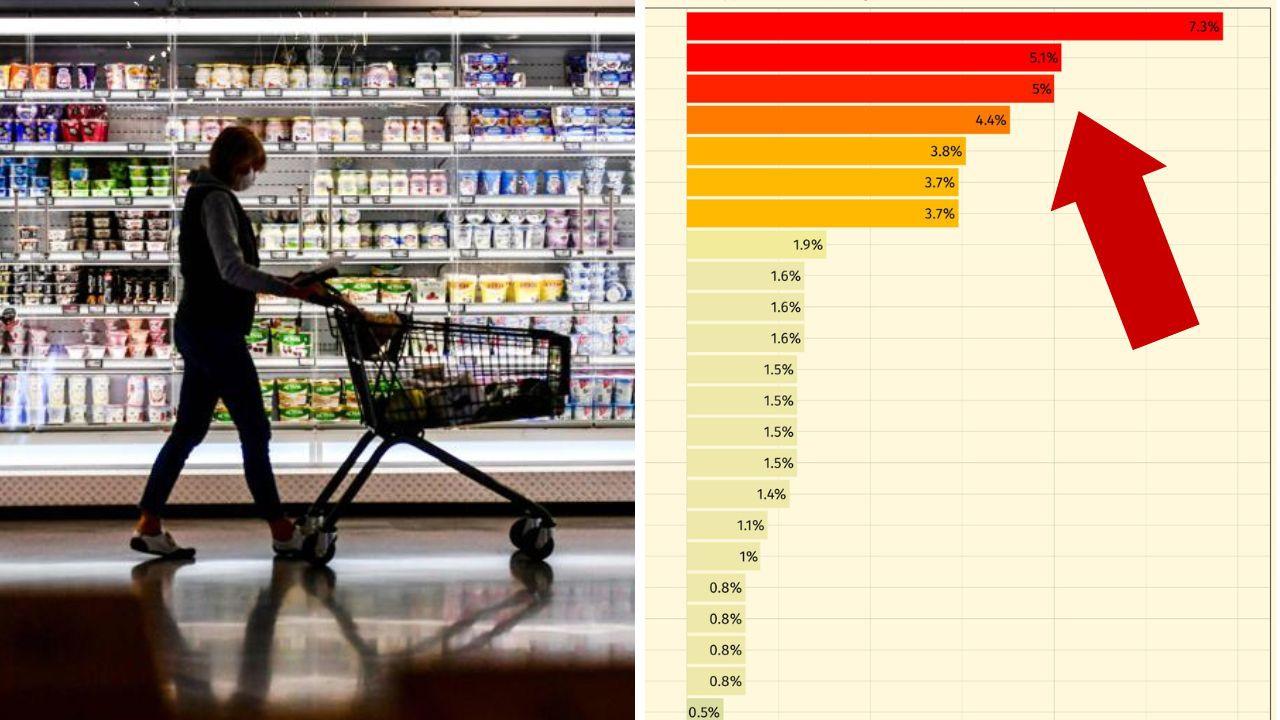

Australia is in the throes of an economic crisis as inflation rose to 6.1 per cent last month, the highest level it’s been for 20 years.

And for the first time in more than a decade, Australia’s central bank has had no choice but to increase the cash rate in a bid to stop rampant inflation.

For the last four consecutive months, the Reserve Bank of Australia has increased interest rates by 1.75 percentage points and Mr Comyn more rate increases will come.

Mr Comyn told the publication his bank predicts the cash rate to increase by another 75 basis points to sit at 2.6 per cent.

The cash rate is currently 1.85 per cent.

Once the cash rate hits 2.6 per cent, Mr Comyn said the economy would experience a contraction of 1.5 per cent.

He said he “hoped” that once the cash rate reached this point it would be enough to curb spending, adding “We need to see a slowdown in demand.”

Speaking to the ABC, Mr Comyn said “We do forecast recessions in the US, UK and Europe. We don’t believe that that’s the likely outcome in Australia.”

Already there are signs that Australians are splashing their cash less.

Mr Comyn said their customer data shows that spending is falling for both debit and credit cards.

This was significantly more for customers who had mortgages.

“It’s quite early post the immediate rate rises, [but] we are already seeing a downturn in spending across our customer base, both from a debt and credit perspective,” he said.

“Of course, that’s more pronounced with customers who have a home loan, and we expect that it will continue throughout the course of the calendar year.”

.