Rising interest rates and uncertainty are causing the property market to cool around Australia. Sydney and Melbourne markets are leading the decline at -2.7 per cent and -0.9 per cent respectively, looking at CoreLogic data.

Based on the Australian Bureau of Statistics (ABS) average property price of $1.2 million in Sydney and $966,500 in Melbourne, this reflects respective discounts of $32,999 and $8699 on the average property today.

With inflation at a 21-year high of 6.1 per cent and interest rates at 1.85 per cent and tipped to continue to rise, it seems likely there will be more pressure on property prices in the short term.

But maybe this could be a good thing. Watching the huge property run over the last couple of years, many people were either priced out of the market or felt property had become overcooked.

With prices on the decline, is it now a smart time to jump in?

State of the property market

Through 2020-21 we saw the value of all property in Australia increase by 23.7 per cent, the strongest growth seen since 2003. In contrast to the weak property market we’re seeing today, for the same time last year the average house price rose $107,000 in Sydney and $41,000 in Melbourne in just three months.

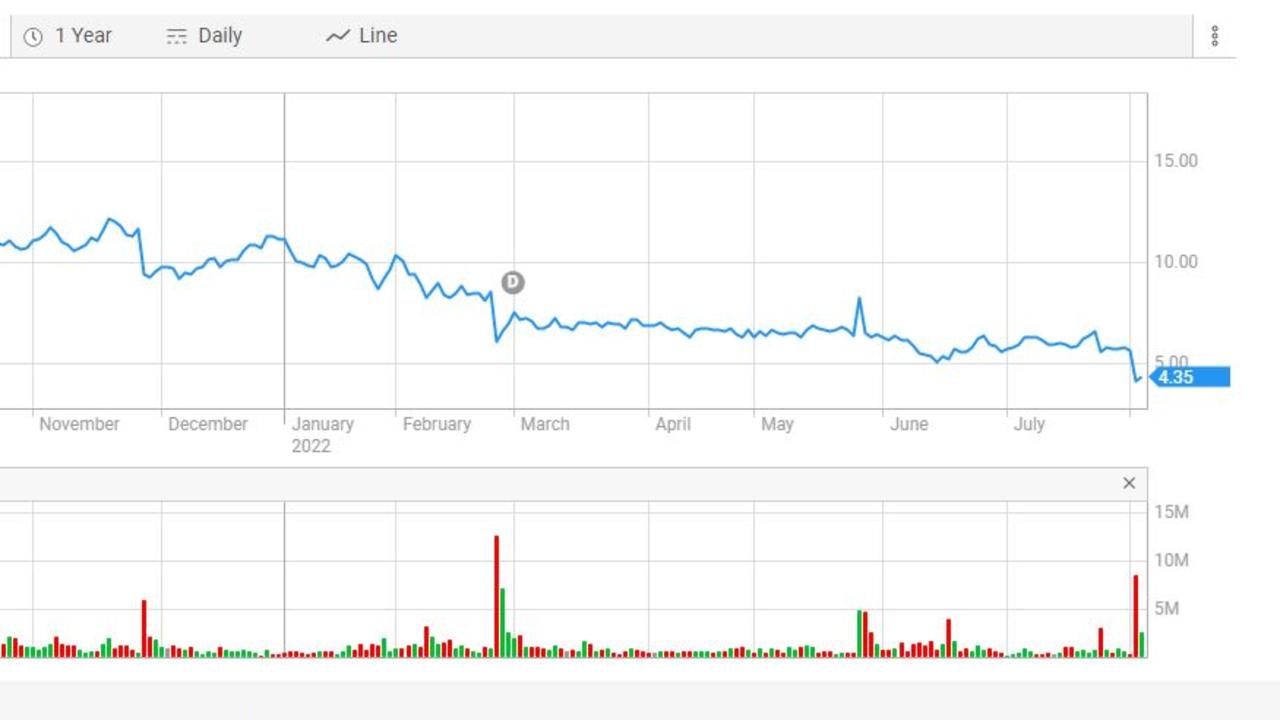

In 2022, we’ve been seeing declines driven by rising interest rates and uncertainty about how the Australian economy is going to ride out the current inflation crisis. The Reserve Bank of Australia (RBA) initially forecast a 15 per cent decline in the property market by the end of 2023, with further falls predicted in 2024.

Worth noting is that not all areas have been (or likely will be) impacted by this downturn equally. We’re seeing property prices hold up more in areas with strong demand and limited supply, and prices weaker in areas that don’t have the same fundamentals. This trend is likely to continue throughout this period of property market disruption.

The key driver of softer property prices is rising interest rates, which have increased by 1.75 per cent over the last four months adding thousands to the cost of repayments on the average Aussie mortgage. With rates forecast to continue rising through 2022 as the RBA grapples with the current global inflation crisis, further pressure will be placed on borrowers and the property market as a result.

Advantages of buying property now

With the property market softening and fewer buyers in the market, people buying property today are doing it at a solid discount to the prices we’ve seen recently.

There’s a lot of fear and uncertainty out there. In my experience helping people with their investing through up and down markets, I’ve found that this uncertainty creates opportunity.

During the height of the Covid crisis there was also a lot of talk about the potential for big property market declines, and a lot of people were too fearful to buy property. Many people were sitting on the sidelines waiting for the uncertainty to pass, convinced there would be a huge crash that would allow them to pick up even more of a bargain.

But before we knew it, the ‘crisis’ was over and the uncertainty was gone. The property market didn’t fail as far as was expected, and many people missed the boat.

In my view, the current conditions are perfect for property buyers to pick up a bargain.

Disadvantages of buying property now

That being said, buying property today does come with risk. The main one that any property buyer needs to manage in the short-term is the likelihood of interest rates rising further.

Rising interest rates for property buyers today mean that you’re highly likely to be paying more for your mortgage in six months than you are today. As mentioned above, rates are tipped to raise around 2 per cent from their current levels in the short-term – meaning you need to be prepared and ready to fund higher mortgage repayments.

There is also potential for property values to fall further in the short-term. Buying and then selling property is an expensive exercise, so you never want to be forced to sell a property. But when values are declining, it’s even more important to protect yourself.

When is the best time to buy property

Looking back, it’s easy to identify ‘good’ times to buy property, but nobody has a crystal ball. We never really know where the property market is going until it actually happens.

And further, while there have been times that we can see would have been better than others to buy property, values have consistently risen over the long-term. That means that over any 10-year period, your asset would have increased in value.

This suggests that the best time to buy was always 10 years ago. The second best time is today.

My view is that if property is on your money road map, now is a great time to buy. You’ll be able to take advantage of the uncertainty, pick up an asset that was a good investment six months ago at a higher price, and move forward on your money journey.

Finding a good quality property is crucial, and having a rock solid plan absolutely necessary to protect your risk. But get these two things right and you’ll be set for success, and will position yourself to come out of this period of disruption in a stronger position than you went into it.

The wrap

Buying property is scary at the best of times, but when fear and uncertainty are high it’s even harder. But property has been one of the most effective ways to invest to build wealth for the last hundred or so years in Australia, and I don’t see that changing any time soon.

Take the time to get your approach right, then make it happen – your future self will thank you for it.

Ben Nash is a finance expert commentator, podcaster, financial adviser and founder of Pivot Wealth, and author of the Amazon best-selling book ‘Get Unstuck: Your guide to creating a life not limited by money’.

Ben has just launched a series of free online money education events to help you get on the front financial foot. You can check out all the details and book your place here.

Disclaimer: The information contained in this article is general in nature and does not take into account your personal objectives, financial situation or needs. Therefore, you should consider whether the information is appropriate to your circumstances before acting on it, and where appropriate, seek professional advice from a finance professional.

.