It’s not the prettiest, or even most fulfilling, part of upgrading a home. But more energy-efficient heating, cooling, power and water usage can net savings that really adds up for household budgets and for doing right by the planet.

Congressional action this weekend and into next week looks to return more incentives, mostly via tax credits and rebates, to the pockets of homeowners who opt for energy-efficient choices, replacing fossil-fuel furnaces, boilers, water heaters and stoves with high-efficiency electric options that can be powered by renewable energy.

Read: Senate passes Democrats’ big healthcare, climate and tax package after marathon session

Of course, more of the nation’s electricity grid, currently run on natural gas NG00,

-2.15%,

along with lingering coal, and expanding wind and solar ICLN,

+0.76%,

will have to be powered by renewable energy for home upgrades to be truly green. But, alternatives are rising in use, and home efficiency has long been considered a good place to start.

The bill, a long-fought and greatly-downsized Democrat-crafted spending bill now known as the Inflation Reduction Act, includes rebates or a tax break for qualifying consumers who add efficient heat pumps (which, despite their name, move cold air around too ), rooftop solar, electric HVAC and electric water heaters.

The IRA was passed Sunday in the Senate and now makes its way to the House next week, where it is expected to be approved by a narrow majority for Democrats in that chamber. The Republicans who have opposed the bill have done so based on disagreements, they say, with the level of spending, but also because some support US oil and gas production on the grounds of cost savings and global security. And Democrats did agree to a future look at expediting environmental approvals for fossil fuels and clean energy.

“American families need relief from Democrat policies that attack American energy, send utility bills soaring and drive up prices RB00,

at the pump,” said Sen. Barrasso, a Republican of Wyoming who is a ranking member on the Senate Committee on Energy and Natural Resources.

Climate Nexus, an advocacy group, says a survey has shown 67% of voters support providing tax credits and other incentives to homeowners, landlords and businesses to purchase appliances that don’t use fossil fuels (such as electric water heaters, heat pumps, and electric induction cooktops).

What’s in the Inflation Reduction Act for home energy?

The legislation provides for $9 billion in total energy rebates, including the $4.28 billion High-Efficiency Electric Home Rebate Program, which returns a rebate of up to $8,000 to install heat pumps that can both heat and cool homes, and a rebate up to $1,750 for a heat-pump water heater. Homeowners might also qualify for up to $840 to offset the cost of a heat-pump clothes dryer or an electric stove, such as a high-efficiency induction range.

Read: Gas stoves targeted as US congressman alleges consumer watchdog has sat on decades of worrisome health data

and: More and more right-leaning Americans worry about climate change, but aren’t ready to give up gas stoves

Many homes will need their electrical panels upgraded before getting new appliances, and the program offers up to a $4,000 rebate toward that initial step.

“A household with an efficient electric heat pump for space heating and cooling, a heat pump water heater, one electric vehicle and solar panels would save $1,800 a year,” says Jamal Lewis and team, writing a brief on the legislation for the organization Rewiring America.

“These savings will be reflected in lower monthly energy bills, reduced bill

volatility and a lessening of disproportionately high energy burdens within disadvantaged communities,” Lewis said. “Importantly, these savings add up — so much so that if a household invests their energy bill savings from electrifying their home appliances, these savings will grow to over $30,000 after 10 years and $140,000 after 25 years (assuming an 8% annual return). ”

There are also funds in the IRA to be claimed for smaller actions: a rebate of up to $1,600 to insulate and seal a house, and a rebate of up to $2,500 for improvements to electrical wiring.

The program, to be administered at the state level, will run through Sept. 30, 2031, and homeowners would be able to collect a maximum of $14,000 in total rebates. To qualify, household income cannot exceed 150% of the area median income.

For homeowners who do not qualify for the rebates, the IRA provides for a tax credit of up to $2,000 to install heat pumps. And, installing an induction stove or new windows and doors, for example, qualifies for tax credits up to $1,200 a year.

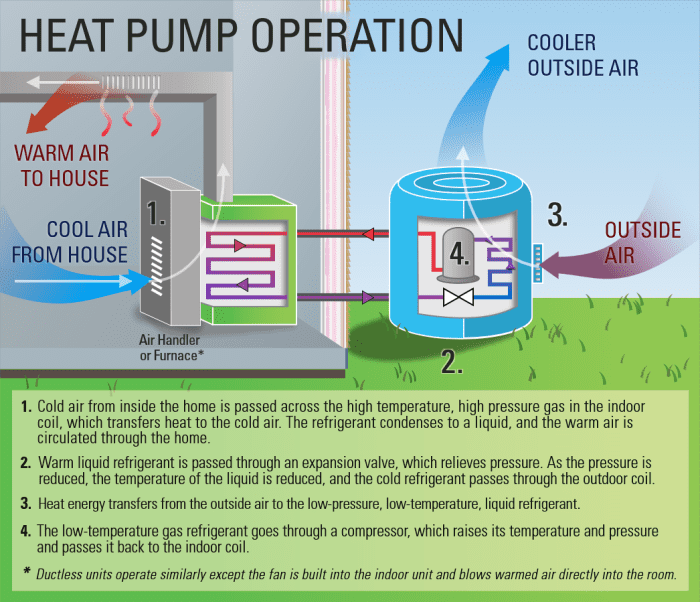

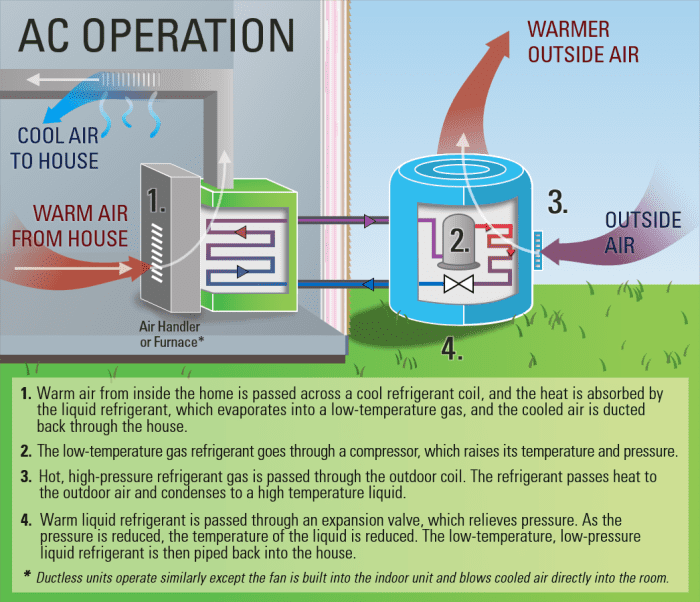

What are heat pumps exactly?

Electric heat pumps, which replace a furnace, for instance, are energy efficient because they don’t create heat by burning fuels but rather move it (during the heating season) from cold outdoors to warm indoors. The downsides can include upfront costs and their suitability for all regions.

Still, over its lifetime, electric heat pumps generally offer the cheapest way to cleanly heat and cool single-family homes in all but the coldest parts of the US in coming decades, according to recent research from the American Council for an Energy-Efficient Economy (ACEEE). In very cold places, the analysis finds, electric heat pumps with an alternative fuel backup for frigid periods minimize costs.

“Our findings are good news for consumers and for the climate. Electric heat pumps, which heat and cool, are the cheapest clean heating option for many houses, especially now that we have cold-climate models,” says Steven Nadel, report coauthor and ACEEE’s executive director.

Cold-climate models, an advance in the technology, operate efficiently at temperatures as low as 5°F. Their energy costs, however, are minimized if an alternative fuel backup kicks in when it gets colder than 5°F for long periods.

The analysis finds that higher-income households are more likely to minimize costs with electric heat pumps, because they have newer—and more likely, single-family—homes with air-conditioning and improved energy efficiency.

The group backs congressional help for low- and moderate-income households, whose homes are often the most difficult to decarbonize. Notably, ACEEE calls for help to reduce the costs of ductless electric mini-split heat pumps in multifamily buildings.

And what about solar?

The legislation revives a 30% tax credit for installing residential solar panels and extends the program until Dec. 31, 2034.

The tax credit would decline to 26% for solar panels put into service after Dec. 31, 2032 and before Jan. 1, 2034.

What’s more, homeowners who install solar battery systems with at least three kilowatt-hours of capacity would also qualify for the tax credit.

The heating-and-cooling provisions are in addition to tax credits of up to $7,500 for the purchase of a new electric vehicle TSLA,

-6.63%

F,

-0.46%

and $4,000 for lower- and middle-income families who purchase a used EV. Early versions of this spending bill included help for e-bikes, but they are excluded in the final. Read more about those EV incentives.

Other programs

Homeowners can look beyond federal programs.

Safak Yucel, assistant professor of operations management at Georgetown University, who studies government policies relating to renewable energy and carbon emissions, said legislative uncertainty given the long slog to get this bill passed, and the risk that executive action is challenged in the courts, means that state and city incentives, and those offered by utilities, may make homeowners more assured.

“A lot of state governments, a lot of cities, they offer quite lucrative deals,” he said. “When it comes to rooftop solar, for example, Massachusetts comes to mind, which is not necessarily the sunniest of states, right, but they have quite a significant adoption of rooftop solar panels thanks to these state-level policies. I think as consumers look forward, they are more likely to see even broader involvement from state governments.”

Website EcoWatch, for instance, allows users to search by zip zode and ranks solar-friendly states.

Will incentives nudge consumer buy-in?

Broadly speaking, the new bill is meant to return more green technology manufacturing back to the US by tagging $60 billion to accelerate domestic production of solar panels, wind turbines and batteries, as well as support the critical minerals processing that are a must-have for the batteries that power EVs and help households leverage their solar power.

More domestic production could help alleviate the supply-chain issues that have hobbled markets during the COVID-19 recovery, and it could create more jobs, all of which is seen helping Americans “green up” their homes and businesses at a lower cost historically, bill proposers argue.

Biden has said the US will work to align with most major economies in the world, hitting net-zero greenhouse gas emissions by 2050, and at least halving current emissions as soon as 2030.

“Electrification will play a crucial role in decarbonizing homes, but the transition will happen slowly as long as inexpensive fossil fuels are widely available,” says Lyla Fadali, an ACEEE senior researcher.

Targeting manufacturing changes can also trickle down to consumers.

“Rather than focusing on whether or not a consumer will buy into the product at this point, what we’re seeing is that the consumers’ hand is sort of going to be pushed over a certain amount of time because so many manufacturers and producers are incentivized to build more solar, more EVs and so on,” said Shannon Christensen, an attorney and a tax and accounting specialist editor with Thomson Reuters Checkpoint, an online research platform.

“When gasoline-powered vehicles came into popularity in the beginning, nobody wanted to switch from their horse and buggy. It took quite some time to get consumers at that time to go over into that new technology. And I think we’re seeing the exact same thing,” Christensen said. “But the technology is getting good enough. And Congress has made it available to lower-income folks and through tax credits. I think that you’re going to see a [demand] shift, and I think it will rise quickly.”

.