An estimated one in five mortgage holders – or 551,000 Australians – will struggle to pay back their mortgage if interest rates continue to rise as expected.

Comparison site Finder found a whopping 20 per cent of mortgage holders will be in serious mortgage distress if their home loan interest payments increase by three per cent. Home loans have already increased by 1.75 per cent since May.

It comes as separate data from S&P Global revealed which suburbs in Australia are most at risk of defaulting on their home loans.

The Northern Territory came out as the worst state, with the highest percentage of mortgage holders more than 30 days behind on payments.

A fringe suburb in Perth topped the list in terms of debt overdue to the bank, while Sydney, Melbourne, Adelaide as well as some regional areas also received a poor rating.

Of even more concern was that the research was conducted before the Reserve Bank of Australia (RBA) starting increasing the cash rate, meaning these areas will be even more at risk of defaulting on their loans now.

For four consecutive months the RBA has hiked interest rates. Last week, after its August meeting, the central bank brought up the cash rate to 1.85 per cent.

The cash rate has already risen by 1.75 percentage points since May, following two years of interest rates sitting at a record low of 0.1 per cent.

Stream more property news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends October 31, 2022 >

According to S&P Global, rising mortgage repayments have hit suburbs on the fringes of big cities the hardest.

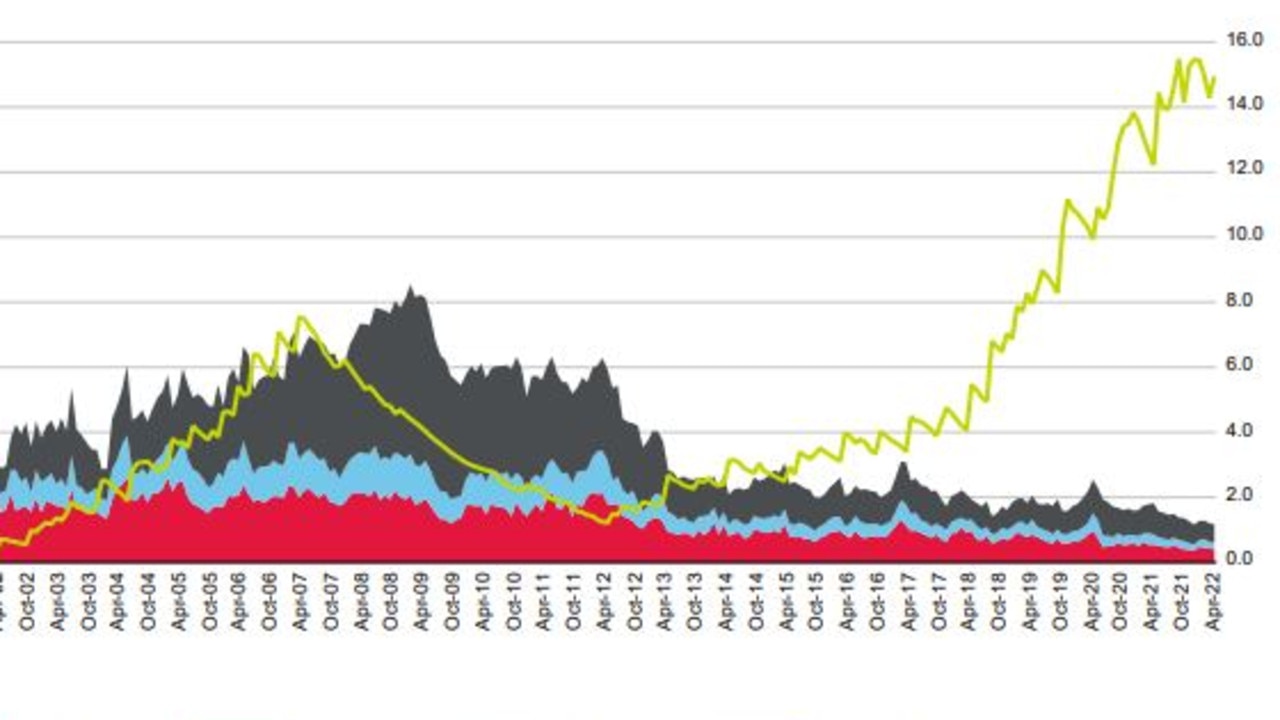

Their research measured the weighted average of arrears more than 30 days past due on residential mortgage loans in publicly and privately rated Australian transactions.

The Perth suburb of Maddington, 20km from the city centre, topped the list of “Worst performing postcodes” in the report.

As of early April, 4.67 per cent of homeowners in Maddington are in arrears.

That was closely followed by Dolls Point, located in southern Sydney.

Of the mortgaged houses in that NSW suburb, 4.33 per cent are behind on payments.

In third place was another WA postcode, Byford, in Perth’s southeastern edge, with an arrears percentage of 4.16 per cent.

Western Australia had one more suburb on the list – Ballidu in the Central Midlands – while NSW had a total of four.

Bankstown and Castlereagh, from Sydney’s west and southwest, were also experiencing substantial pressure. Katoomba from the Blue Mountains, south of Sydney, also earned a spot in the report.

Victoria, Queensland and South Australia each had one suburb on the list – Broadmeadows in Melbourne’s north, Barkly in Queensland’s Mout Isa region and Hackham, an outer suburb of Adelaide.

A breakdown of each state showed that the Northern Territory was the most behind in its mortgage repayments, at a rate of 1.75 per cent.

Western Australia came in at 1.40 per cent, as of April this year, before interest rates started to be hiked.

Victoria received a score of 0.87 per cent while 0.85 per cent of NSW mortgage holders were also in mortgage arrears.

The ACT fared the best, with an arrears rate of only 0.33 per cent.

Overall, the national average was 0.71 per cent for Australia’s arrears rate, as of April.

“The swift pace of interest rate rises will create debt-serviceability pressures for households with less liquidity buffers and higher leverage,” the report noted, forecasting that sometime in the third quarter of this year a higher arrears rate would show up in new monthly date .

Finder also released a damning statistic about the state of Australia’s home loan debt.

A recent survey conducted last month concluded that more than half a million homeowners would be “on the brink” if interest rates rose by three per cent.

Of those, 145,000 Australis said they would consider selling their home if rates jumped because they would “struggle a lot” to repay them. That represents about five per cent of Australia’s mortgage holders.

The survey also found that 14 per cent of admitted respondents they might fall behind on their repayments or other bills.

Nearly half (48 per cent) would be able to manage, but would have to cut down on their spending, according to Finder.

Only a quarter of participants said a rate rise would not change their lifestyle or spending habits at all.

.