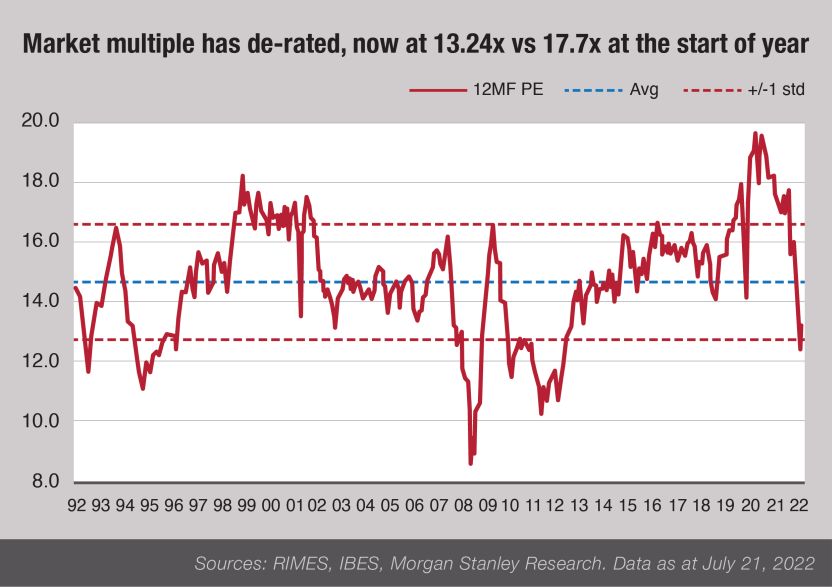

The Australian share market has risen for the third consecutive week, with the ASX 200 rallying 1.01% for the week and 5.83% over the past month to close trade on Friday at 7015.6 points.

Whether we are witnesses a bear market rally or merely a correction in a large bull market is yet to be seen, however positive shoots are appearing.

RBA raises rates again

The Reserve Bank of Australia (RBA) lifted the cash rate on Tuesday by 0.5%, taking the overall rate to 1.85%.

The highest it has been in six years.

RBA’s governor Philip Lowe hinted that rate rises from here on in will be more modest, adding that “inflation is expected to peak later this year and then decline back towards the 2–3% range.”

Commercial banks follow suit

Joining in on the RBA rate rise is Australia’s major banks, confirming they will pass on the hike on their variable mortgages by 0.5%.

Despite the big four making the move to raise rates on borrowers, only some savings accounts will see an increase. With savers still being overall punished by inflation being higher than the rate of return from the banks.

Retail sales for June saw a surprising 1.4% rise in volume and 12% increase year-on-year in dollar terms.

However the increase is largely a reflection of price rises and the end of government imposed lockdowns.

Overall sentiment and rate rises have started to impact on Australia’s property market, with prices beginning to cool in all major markets.

Recession risk remains

England’s central bank didn’t mess around this week either, raising interest rates by 0.5%, to an overall rate of 1.75%.

The largest rate increase in 27 years.

What was more attention grabbing was the Bank of England’s (BOE) prediction that a long recession is on its way.

The BoE expects inflation to peak at 13.3% in October, stating that the UK economy would begin to shrink in the last quarter of 2022 and contract throughout all of 2023, making it the longest recession since the global financial crisis.

Further signs of inflation may be peaking is the oil price now at pre-Ukraine war levels.

With crude oil today trading at US$87 per barrel, down significantly from its recent peak of US$126 per barrel.

Small cap stock action

The Small Ords index climbed 2.02% for the week to close on 3016.8 points.

Small cap companies making headlines this week were:

ioneer (ASX: INR)

Emerging lithium producer ioneer inked another binding offtake agreement for lithium carbonate produced from its Rhyolite Ridge project in Nevada.

The five year agreement was made with battery manufacturer Prime Planet Energy & Solutions, which is a joint venture between Toyota Motor Corporation and Panasonic.

Over the term, Prime will purchase 4,000tpa of lithium carbonate from the operation – accounting for about 19% of expected annual production.

The deal follows other offtake deals with Ford and EcoPro, which have each agreed to take 34% each of the mine’s annual planned lithium carbonate.

ioneer says the three offtake agreements represent the completion of all its pre-production commitments for lithium carbonate from Rhyolite Ridge.

BPH Energy (ASX: BPH)

BPH Energy and its investee Advent Energy have completed a 10% acquisition of Clean Hydrogen Technologies.

The deal involved BPH scooping up US$800,000-worth of Clean Hydrogen shares – giving it an 8% interest.

Advent purchased US$200,000-worth of shares, which gave it a 2% stake.

Both BPH and Advent have a further right of refusal to pick-up another 10% equity in Clean Hydrogen for a combined $1.42 million before the end of the year.

Clean Hydrogen has developed technologies to produce hydrogen and carbon black and carbon nano products, using less energy and without emitting carbon dioxide. The technology uses natural gas as the feedstock.

Frontier Energy (ASX: FHE)

Emerging clean energy producer, Frontier Energy debuted on the US-based OTCQX market this week under the ticker FRHYF.

The secondary US listing is to enhance visibility and accessibility of Frontier to North American investors.

News of the US listing came after Frontier announced it was acquiring extra land for its primary Bristol Springs solar project in Western Australia’s South West.

The company secured exclusive options to acquire 6.51sq km of land for the project – adding to the existing 1.95sq km, where it plans to produce 114MWdc of solar energy.

This extra land will enable Frontier to realize its green hydrogen production strategy, which it is closer to achieving after a pre-feasibility study forecast it would have a total unit cost of $2.83/kg of hydrogen produced.

Frontier says this would place Bristol Springs as one of the lowest cost green hydrogen producers in Australia.

Kairos Minerals (ASX: KAI)

Gold explorer Kairos Minerals attracted investor interest this week after it revealed assays for spodumene pegmatites it had discovered at its Mt York project.

The pegmatites had been uncovered during drill pad construction in readiness for a gold drilling program at the Lucky Sump prospect.

Five pegmatite samples that were assayed returned peak results of 1.91% lithium and 103ppm tantalum; 1.56% lithium and 115ppm tantalum; and 0.58% lithium and 167ppm tantalum.

Kairos plans to follow the discovery up with more sampling and mapping plus a major drilling campaign.

Lucky Sump is adjacent to Pilbara Minerals’ Pilgangoora lithium operation and about 25km from Albemarle and Mineral Resources’ Wodgina mine.

It is suspected Lucky Sump could be a southern extension to Pilgangoora.

Incannex Healthcare (ASX: IHL)

After completing its acquisition of APIRx on Friday, Incannex Healthcare officially has the world’s largest portfolio of patented medicinal cannabinoid formulation drugs and psychedelic treatments.

The acquisition was announced in March and APIRx co-founders Dr George Anastassov and Lekhram Changoer have joined Incannex as non-executive director and chief technical officer, respectively.

APIRx has 22 clinical and pre-clinical research and development projects, with aggregate addressable markets of US$400 billion a year.

The acquisition follows Incanex’s announcement earlier in the week it was scaling up the manufacture of IHL-216A, which is a neuroprotective drug designed to treat concussion and traumatic brain injury.

Incannex engaged Curia to scale the fill-finish manufacture of IHL-216A in compliance with current Good Manufacturing Practice (cGMP) and generate data on the quality and stability of the drug to underpin future regulatory filings.

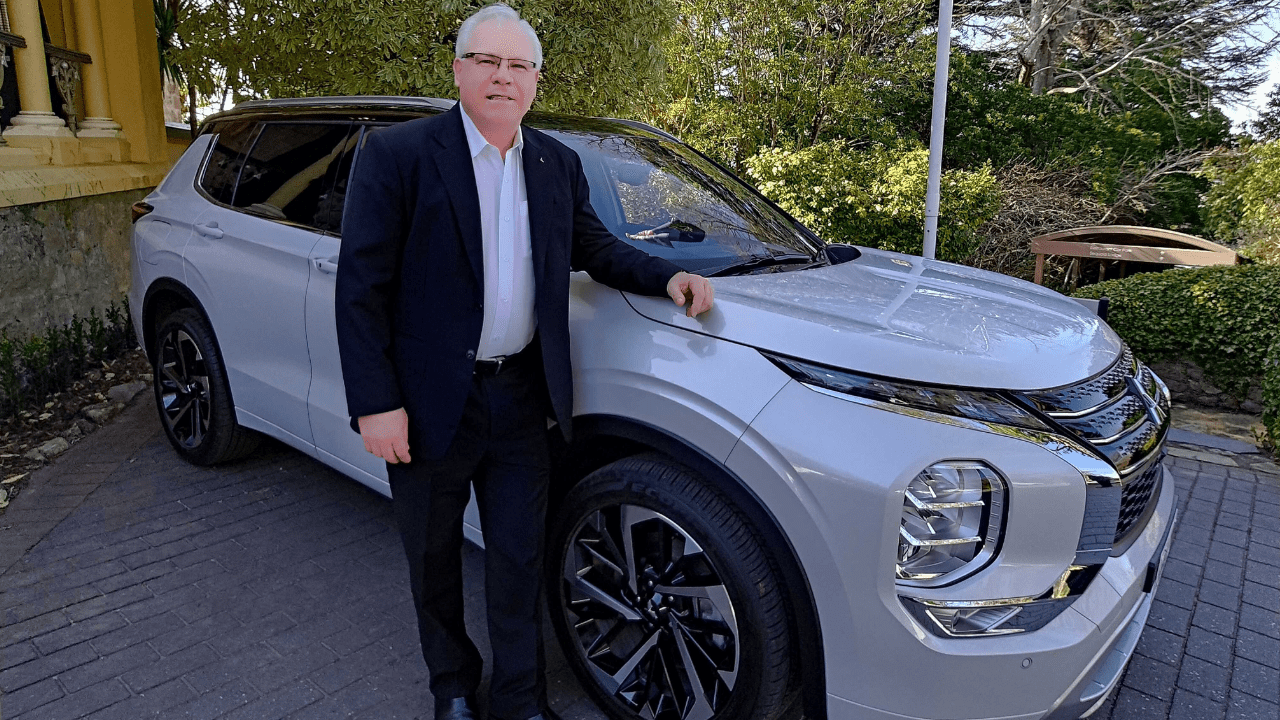

European Lithium (ASX: EUR)

BMW AG is the latest major auto manufacturer to secure a direct lithium hydroxide supply after it inked a non-binding memorandum of understanding with European Lithium.

European Lithium has agreed to grant BMW first right to 100% of the lithium hydroxide produced from its identified resources at the Wolfsberg project in Austria.

In the event the parties agree to a binding contract, BMW will make a US$15 million up front payment, which will be used to advance Wolfsberg.

A definitive feasibility study on Wolfsberg is targeted for completion in the December quarter.

The week ahead

On the local front, consumer and business confidence numbers are out mid week, along with consumer inflation expectations and new home sales for July.

Over in the US inflation numbers for July will reveal how far behind the curb the Federal Reserve is in what it once dubbed as ‘transient inflation’, which has been anything but.

Analysts are forecasting inflation to once again read 9.1% for July, the same as for the month of June. This was the highest inflation reading in over 40 years.

Meanwhile over in China, inflation and industrial production numbers for July will be revealed.

Granted these inflation numbers are a look back in time, however it is clear that the globally synchronized central bank policy of rates held to near or below zero percent in most countries for over a decade and excessive money printing is seeing inflation spiral out of control and the cost of living rises for people around the world.

This week’s top stocks