The cost of living is soaring. Rocketing food prices and rising interest rates mean that without a substantial rise in wages, workers find themselves going backwards.

Key points:

- Without high wage growth, inflation means workers’ living standards will decline

- Wage growth has been low for a decade

- Wages in New Zealand are rising to meet inflation

So are wage rises coming?

Ahead of official data out next week there are conflicting signals about what’s going on with wages.

going up

The good news, if you’re a worker, is that it’s a great time to be you.

Job vacancies are at a record high and there’s a massive shortage of labor (partly because so many migrants have gone home since the pandemic began and haven’t returned).

For advanced manufacturing company ANCA, that means paying people more.

“If we don’t have the right people, then we’re not going to be able to succeed in the marketplace. So we’ve got to pay what the market’s asking,” says the company’s strategy and community manager Johanna Boland.

“I think it’s not just inflation, it’s also been a really hot market for talent.”

ANCA is competing with tech companies, banks and start-ups for software engineers and designers with in-demand skills. It employs 1,300 people globally, most in Bayswater in Melbourne’s outer suburbs.

The staff work in a variety of divisions, making things like complex robotic tools and components. Its machines are used by other companies in high-precision work, for example in cutting components used in mobile phones and medical equipment.

Early this year some staff started asking for more money to deal with rising living costs. The company did a “wide-scale analysis” looking at its entire staff and lifted wages for all.

The budget for wages has already changed since May and at the review in October it will be more again.

ANCA staff will get more money. Will you?

Kiwi wages lift

Australia’s unemployment rate is at its lowest level since 1974, at just 3.5 per cent. In New Zealand it’s down to 3.3 per cent – and it was even lower in the previous quarter.

(Even though it’s a blunt measure, with someone working an hour a fortnight considered “employed”, it is the measure generally used globally.)

That should mean higher demand for workers, leading to a boost in wages. In Australia that hasn’t happened yet, but New Zealand figures out this week show big lifts in how many workers are taking home in pay.

We have similar economies – and in New Zealand average hourly earnings are up to 7 per cent, year on year, for workers in the private sector, those not employed by governments. That’s almost catching up to the consumer price index (inflation) growing at 7.4 per cent.

Also, 26 per cent of jobs surveyed received a pay rise of more than 5 per cent, the highest proportion since 2008. And about two-thirds of jobs received an increase in ordinary-time wage rates in the past year –the highest level on record.

breaking history

Australians aren’t getting that kind of a boost. They’re going backwards.

The Reserve Bank of Australia see wages rising about 3.5 per cent next year, but that’s a significant pay cut in real terms. That’s because inflation is expected to peak at 7.75 per cent by the end of this year, be about 6.2 per cent by the middle of 2023 and 4.3 per cent by the end of next year.

So prices will keep rising faster than pay packets, meaning a cut in ‘real wages’ for millions of people.

There’s a simple answer on wages, according to Joseph Stiglitz, recipient of the Nobel Prize for Economics:

“They need to be higher.”

“The only thing Australians might feel good about is that they’re better than what’s happening in the United States, where things are devastating,” he said during a visit to talk to parliamentarians, trade unionists and business leaders.

Asset prices like houses and stocks have soared during the pandemic. A decade of low wage growth means people who get their income from wages are falling behind.

“The price of inequality is that low-paid workers are less productive. If we as a society reduce inequality, we’ll have a better performing economy. Better paid workers are less anxious… more satisfied, less likely to quit.”

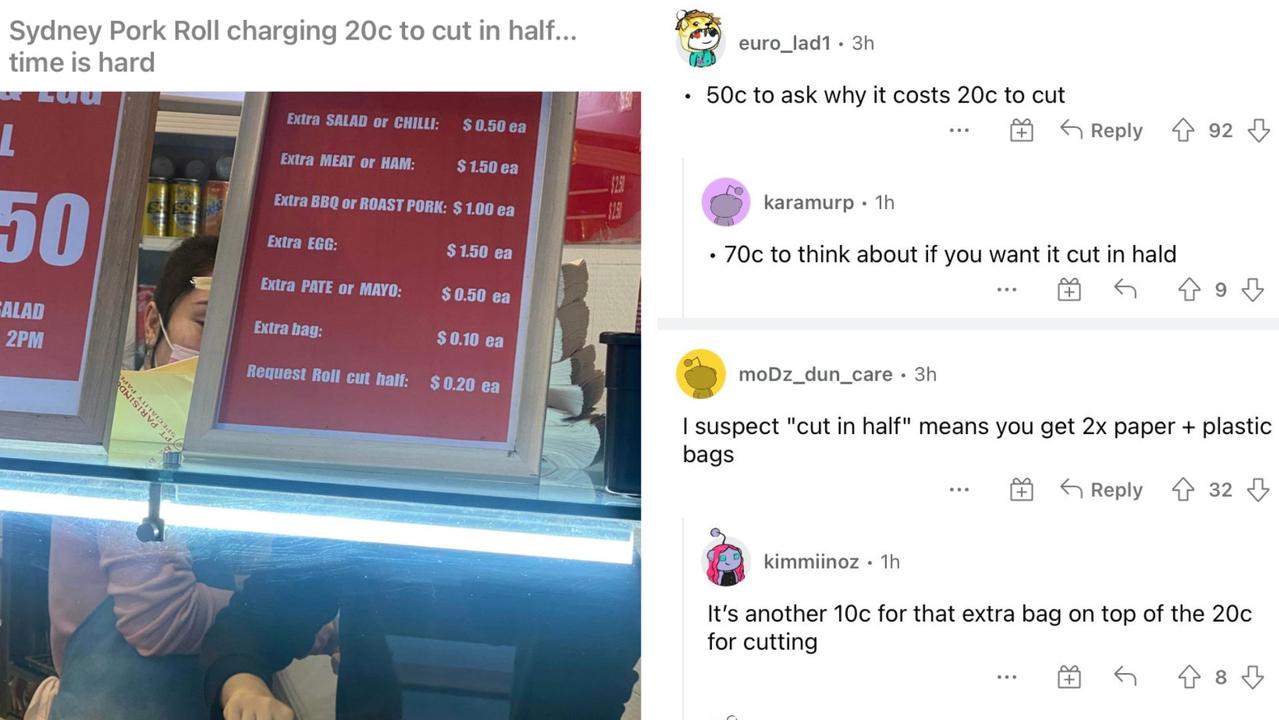

Cost pressure

For many businesses, it’s not easy to raise wages.

Peter Burn, director of public policy at the Australian Industry Group (Ai Group), notes salaries are a big cost. But they’re just one, and many of the other major elements that go into running a business have already asked for more.

“Cost pressures are widespread,” he said.

“There’s cost pressures coming from energy costs — electricity and gas, petrol — freight has been a major cost increase for a lot of businesses. The prices of building materials have risen very sharply, digital equipment [too]. They’re the big ones we’ve been hearing about.”

Dr Burn says these costs are particularly strong, but they also flip what’s become normal.

“We’ve become used to low or even falling prices in recent years. So this is a sudden reversal of what we’ve become used to,” he said.

He sees “big gaps” in the wages picture. There are aggregates (for everyone) of around 2.5 per cent growth, but certain industries and roles are seeing sharp wage rises.

“But what we’re hearing from particular businesses is they’re increasing the wages, they’ve got to pay (bigger) salaries attract particular staff,” he says, pointing to tech and project management as key fields enjoying substantial leaps in salary .

That’s putting wage pressure on businesses those business, he adds.

“But as a general rule across the economy, wage pressures are not high.”

Job seeking

Australia’s largest job site is a gold mine of information about what’s happening with wages. Or it could be.

“So most employers don’t put the salary on the job ad,” advises Kendra Banks, managing director of Seek. “This is something we do advise employers to think about more carefully. If the salary is good, if they think it’s above average, it will certainly attract more applicants.”

Why don’t they – especially in a tight labor market where people are looking to make more money to meet the cost of living? Because they cause chaos in their workplaces.

“It’s quite often in some organizations that newcomers will have different salary levels than the existing employees. So advertising that through the ad could create challenges internally for some companies or organisations,” she says.

This is like the so-called ‘loyalty premium’ paid by consumers. Long-term bank customers with a home loan, for example, are sometimes shocked to learn that people walking into the branch and taking out a mortgage are offered a better rate.

In jobs, too, there’s a benefit to switching.

“We see that through some of the ABS data that looks at wage changes for people who’ve moved employers and those who haven’t,” Ms Banks says.

“And the wage change for those who’ve moved employers is significantly higher than those who haven’t.”

With other costs rocketing, employers may be offering inducements that aren’t money.

“Participation in the labor market in Australia is already very, very high, so it may be that wage growth is not exactly what it takes (to lure workers),” she adds.

Perks like flexible working, the ability to work from home, to set your own hours and leave stronger entitlements may be areas “employers are leaning on more in order to attract the best candidates.”

Cost pressure

Switching employers might bring more money, but for many workers it’s not possible or desirable. They have to either push their boss for a bigger pay packet, or wait for external pressure to do it.

And that might not eat.

“For 10 years, we’ve been told that some Magic Wage Growth Fairy will come along and one day boost wages,” says an exasperated Richard Denniss, chief economist of the Australian Institute.

“The reason we have low wage growth is because employers are not offering decent wage rises.

“The only way that wages can grow in Australia is if employers pay their workers higher wages. And every employer, including the public sector is saying, ‘Oh, we can’t afford to offer high wage growth’.

“So unless lots of employers are offering wages that start with a 5 (per cent), then we’re not going to see average wage growth start with a 3.”

Data out on August 17 from the Australian Bureau of Statistics will let us know what’s happened to wages in the recent past. What happens in the future is up to workers, unions, bosses, governments and companies.

“The way a market is supposed to work is when something is scarce, the price goes up,” Dr Denniss says.

“That’s what’s happened with gas. But when it happens with labour, apparently there’s a problem.”

.