Aussies are well aware that the cost of living is increasing. Prices of food, gas, petrol and rent have skyrocketed thanks to the inflation rate rising to 6.1 per cent in June – to 21-year high.

While the Australian Bureau of Statistics reported a 2.4 per cent rise in annual wage growth for the March quarter, this has not been enough to compete with the soaring cost of living, leaving people struggling around the country.

But we’re not the only ones.

The Organization for Economic Co-operation and Development (OECD) is an international organization that includes 38 countries such as Australia, the USA, Canada, New Zealand and the UK.

International events such as supply chain interruptions, COVID-19 implications and the war in Ukraine saw inflation in OECD countries rise to 9.6 per cent in May compared to 9.2 per cent in April. This represents the sharpest price increase since 1988.

Here’s a crash course in inflation and what it looks like around the world.

What is inflation and what causes it?

Inflation measures how much more expensive a set of goods and services has become over a certain period of time.

The most well-known indicator of this is the Consumer Price Index (CPI).

The CPI measures the percentage change in the price of a basket of goods and services consumed by households.

Temporary changes in inflation may be caused by events like supply disruptions or seasonal sales, according to the RBA.

More persistent changes in inflation generally arise when people and businesses change their expectations about future price moves, and thus start demanding higher wages or passing on cost increases to their customers to compensate for them.

In the worst case, these expectations of rising prices can cause inflation to spiral out of control.

United States of America

inflation rate: 8.5 per cent

Price of fuel: $1.52 p/L (AUD)

Average house price: $492,433 (AUD)

It has not been a great year for inflation in the United States, according to the Department of Labor.

The US CPI has been rising throughout 2022, arriving at a 40-year high of 9.1 per cent in June.

Not the only bad news in June, inflation-adjusted incomes based on average hourly earnings fell 1 per cent, down to full 3.6 per cent in comparison to the previous year.

July’s inflation update gave Americans a small amount of hope to grasp onto, with the inflation rate lowering to 8.5 per cent.

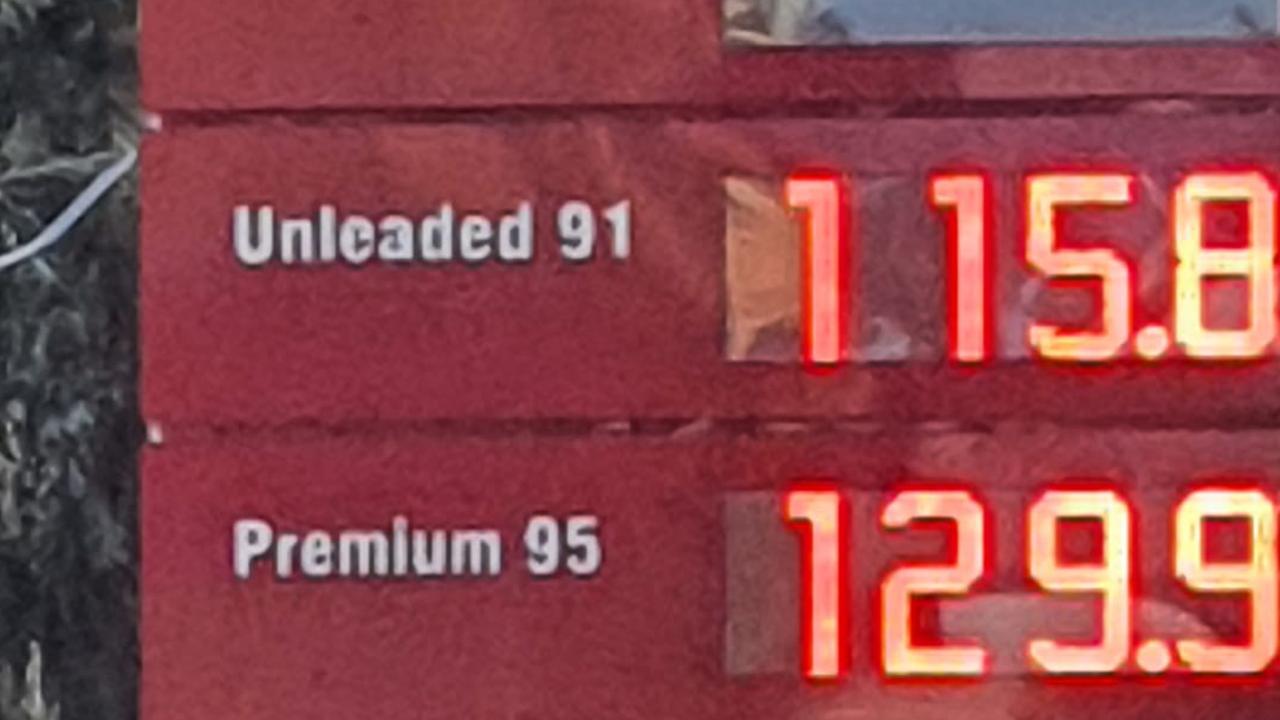

new zealand

inflation rate: 7.3 per cent

Price of fuel: $2.72 p/L (AUD)

Average house price: $895,088 (AUD)

Akin to Australia, New Zealand has been weighted under rising costs increasingly during 2022 according to Stats NZ, New Zealand’s official data agency.

As of June inflation as rising to 7.3 per cent, which the agency says is largely driven by rising prices for housing construction and rentals for housing.

Prices for the construction of new dwellings increased 18 per cent in the June 2022 quarter compared with the June 2021 quarter.

“Supply-chain issues, labor costs, and higher demand have continued to push up the cost of building a new house,” Stats NZ general manager Jason Attewell said.

“The 18 per cent annual increase in the June quarter follows an 18 per cent increase in March and a 16 per cent increase in December 2021.”

An August report from the agency also noted that the food prices had increased 7.4 per cent in July 2022 when compared to July 2021.

United Kingdom

inflation rate: 9.4 per cent

Price of fuel: $3.03 p/L (AUD)

Average house price: $505,739 (AUD)

According to the UK’s Office for National Statistics, June’s Consumer Price Index figure of 9.4 per cent was the highest annual CPI inflation rate since 1997.

One of the biggest contributors to the June quarter increase was the soaring price of motor fuels and electricity.

Compared to June 2021, there was a 42.3 per cent rise in the price of motor fuel with average petroleum prices breaking $3 (AUD) a liter. This is the highest price on record since 1990.

The cost of food also had an impact on the CPI rise with food and non-alcoholic beverage prices rising by 9.8 per cent in the year to June 2022 – the highest rate ever since March 2008.

The largest upward effect came from milk, cheese and eggs.

Canada

inflation rate: 8.1 per cent

Price of fuel: $1.84 p/L (AUD)

Average house price: $736,204 (AUD)

In June, Canada experienced that largest annual change to CPI since 1983, reaching 8.1 per cent year over year according to Statistics Canada.

Like with other parts of the world, the price of petroleum remained one of the sore spots for price rises. On a year-over-year basis, Canadians were paying 54.6 per cent more for petroleum in June.

On a monthy basis, demand for passenger vehicles remains high with the price for new cars increasing 1.6 per cent and used cars by 1.3 per cent in June.

Prices for service like rent also rose 5.2 per cent year over year in June.

Germany

inflation rate: 7.5 per cent

Price of fuel: $2.46 p/L (AUD)

Average house price: $296,447 – $566,771 (AUD)

Since May this year the German CPI has been steadily dropping month by month, settling in at 7.5 per cent, according to the Federal Statistical Office of Germany.

However, this remains higher than normal due.

“The main reason for the high inflation still is price rises for energy products,” said President of the Federal Statistical Office Dr. Georg Thiel.

Dr Thiel points to two energy relief measures introduced by the German government as having a slight downward effect on inflation – fuel discounts and the introduction of a nine-euro monthly train travel pass.

.