A group of sophisticated scammers have stolen a quarter of a million dollars from a widow in NSW.

Lily*, a retiree from the NSW Mid North Coast near Port Macquarie, has been left reeling after learning she poured her $250,000 fortune into a fake investment scam.

The woman’s term deposit account was maturing and she was searching for a better return on her money.

In February this year, she was paying for her groceries at her local Woolworths when she picked up a magazine that had an advertisement inside it for an investment company called Capel Court.

“I contacted Capel Court as a result of the advert in the publication I’d seen, I’d noted the phone number and I rang them,” Lily recalled.

The so-called investment company had an online login portal and multiple employees with mobile and office phone numbers listed.

After going back and forth with company representatives for several weeks, including having a solicitor look things over, Lily eventually transferred her money in March believing she was investing in a European Investment Bank government bond.

Just a few months later news.com.au exposed that the Capel Court investment scheme was a sham. Including Lily’s losses, scammers have stolen at least $2.5 million that news.com.au knows of from six Australian victims. The highest individual loss totaled $750,000 and even an accountant in his 40s fell for the scheme.

After coming across the article and realizing she had been duped, Lily said, “I was stone cold, absolutely shocked. Probably for two weeks I cried on and off.”

Lily doesn’t have children and her husband has passed away so she was planning to leave whatever was left of her life savings to medical research to help cancer and Alzheimer’s patients.

She spoke to two different scammers who called themselves David Jones and Stephen Jones who answered all her questions and guided her through the process.

They promised her a 6.45 per cent return on her investment, with documents to back that up, which would mean she would be receiving $16,000 per year from dividends.

They tried to pressure her into depositing the money by saying there were limited spots available in the bonds fund as it was oversubscribed.

Lily almost wasn’t able to deposit her money because of the flooding along the east coast earlier this year.

“The flooding came between where I lived and where the bank was,” she said.

During the floods, the scammers called her up several times trying to get her to send the $250,000 onto them.

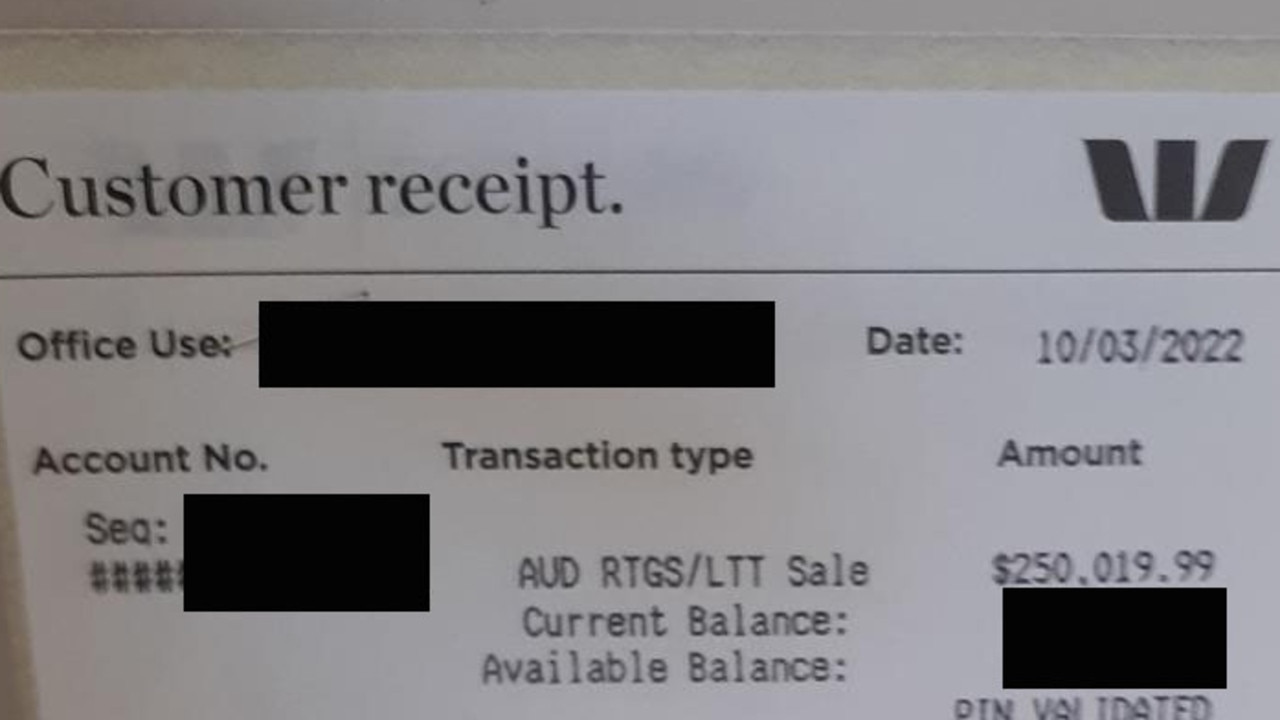

Finally, on March 10, Lily went into her local Westpac branch and by teletransfer, she moved $250,000 into a bank account for an instant payment system called Cuscal.

She claims bank staff didn’t ask questions and partly blames them for this unfortunate situation.

“I didn’t have any more contact [with the scammers] after everything was signed and sealed,” she said.

Have a similar story? Get-in-touch | [email protected]

In May, Lily learned she had been scammed after reading news.com.au’s previous articles.

Sure enough, when she went on the website had disappeared and she wasn’t able to get in touch with David or Stephen Jones.

“I’ve had a shocking two and a half months. I have to be [upbeat] otherwise I’d be so depressed I’d probably top myself,” she said.

Westpac wouldn’t comment on Lily’s individual case citing privacy reasons. They did not respond to questions about how they allowed an elderly woman to transfer $250,000 in one payment without raising the alarm.

“There has been a rise in investment scam activity, and we encourage all Australians to be vigilant,” a bank spokesperson said.

“Westpac invests heavily in scam prevention and has robust processes in place to alert and protect customers. We work hard to recover money for customers where possible.

“Investment scams often promise low risk for high returns. We encourage people to do their research and seek independent financial advice before making an investment.”

Sadly, this is not the first time this scamming syndicate has duped Australians out of hundreds of thousands of dollars.

News.com.au has previously reported on this same group of scammers, who posed as Barclays and Macquarie Bank and EQR Securities.

They scammed one Melbourne man out of $700,000, another schoolteacher out of $500,000, a retired couple lost $200,000 and an accountant fell for it too, losing $160,000. Another widow lost $750,000.

In October last year, retired Queensland couple Antje and Bardhold Blecken had $200,000 stolen from them when they mistakenly believed they were investing in a Barclays Bank term deposit.

Then in March, Melbourne man Andy* thought he was investing $700,000 into bonds with Capel Court. It was fake and he lost his life savings.

Robert*, an accountant, also sank $160,000 into the fraudulent Capel Court group while NSW couple Jody and Corey Bridges lost $500,000 to the same scam.

Michelle Lowry transferred $750,000 to EQR Securities in December last year, which also turned out to be fake.

News.com.au can definitively link these separate scam websites because the same aliases and mobile numbers were used by the fraudsters.

The scammers used multiple aliases including William Hughes, Ben Davis, Jacob Price, Oliver James and of course David Jones.

These particular scammers are fans of rapid payment platforms like Cuscal, Money Tech/Monoova and also cryptocurrency platforms including Binance, TechMarket AU/ED Australia and ElBaite. They have also used bank accounts through the Commonwealth Bank, ANZ, Citibank and NAB to channel money. It’s understood many of these accounts are under investigation.

In May, news.com.au reported on Melbourne widow Jacomi Du Preez, who lost $760,000 from the life insurance payout of her husband in an elaborate Macquarie Bank term deposit website that turned out to be fake.

Luckily, Ms Du Preez realized it was a scam within a day and was able to recover all her money.

A cyber security expert, Nick Savvides, told news.com.au these particular scams are “sophisticated” and “well-resourced”.

He believes it is likely they had a group of at least 20 people working together to steal large sums of money.

The money has probably ended up overseas and could be part of an organized crime gang.

Names withheld over privacy concerns

.