The scene, which looks like something straight out of Alice in Wonderland, is the last ever drawing of a person who, for years, was known simply as “The Drawing Man”.

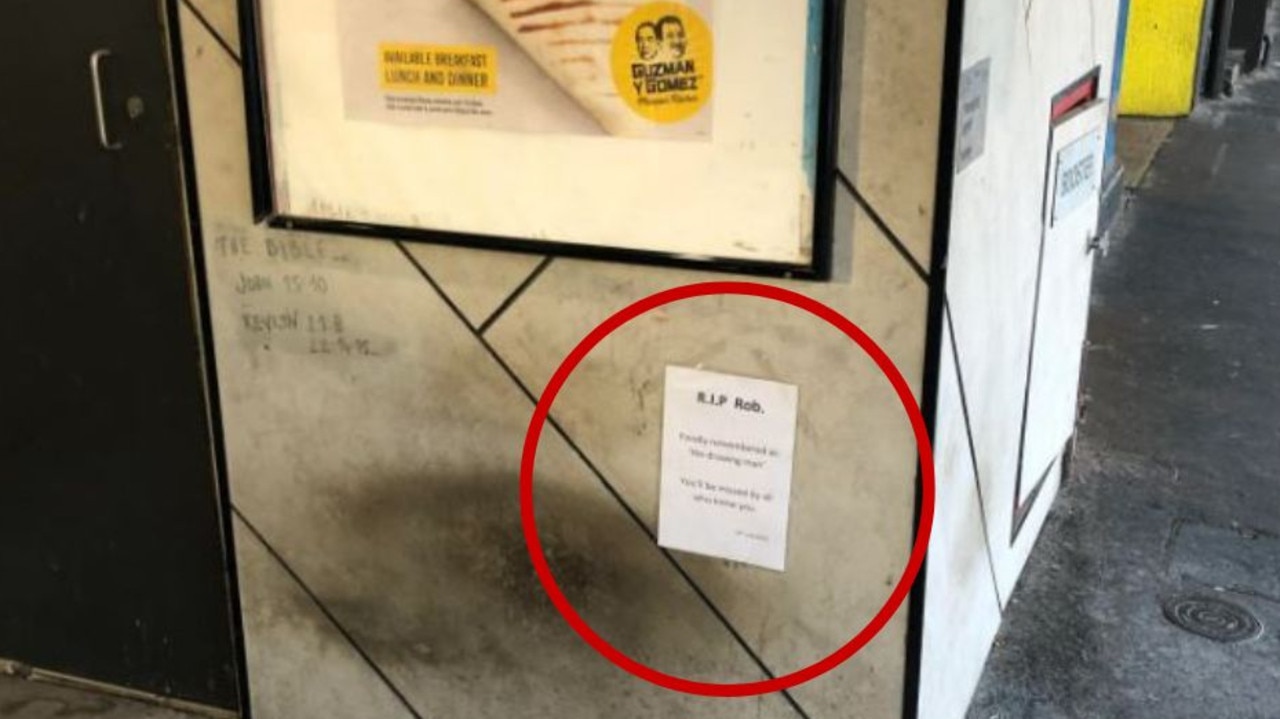

Above his art, taped to a wall that separates Guzman and Gomez and Metro Woolies, is an A4 printout commemorating his death.

“RIP Rob. Fondly remembered as ‘the drawing man’, you’ll be missed by all who knew you,” the paper reads.

It is hard to keep track of those who fall victim to homelessness, with hundreds estimated to die every year.

The issue has been dubbed Australia’s “invisible problem”.

‘Kind, talented, gentle’: Rob’s life in Reddit posts

But Rob was far from invisible. Despite his transient living conditions, he became a beloved member of the Hawthorn community, charming locals with his abstract art and “gentle soul”.

“I moved to the area about five years ago and saw him damn near every time I was going for groceries or lunch,” one local recalled on Reddit.

“He was a fixture on that road, even as shops and people and even time changed.

“I remember first seeing his drawings, the simple houses or suns or vehicles he’d draw. That over time morphed into complex, colourful, abstract art.

“He was a dedicated man, taking the time he was given and putting himself towards creating something beautiful.”

For more than a decade, Rob would frequent the areas outside the Hawthorn Woolworths or Malvern Coles, waving and smiling back at people rushing to catch a tram or popping into a store for a bite.

Reddit users said that while he “never asked for anything”, locals ensured Rob was always looked after by offering to share meals or to sit and draw with him.

But when Covid forced Victoria into lockdown, the communal care began to wane.

“I bought him some art supplies at the start of Covid,” user @mhrauburn, the original poster, said.

“Pre-Covid I would see people getting him things from Woolies but not so much recently. I do hope he passed peacefully.”

For the man who became “part of Swinburne”, many commenters also expressed their sadness knowing they would never again be able to talk to him about his drawings.

‘Slipped through the cracks’

Rob wasn’t always ‘the drawing man’.

A former Swinburne University graduate recalled a chance encounter a decade ago where Rob claimed he had once been an aspiring artist employed at the popular Heide Museum of Modern Art.

“Someone once gave me $20 and told me ‘If you don’t need it posted, give it to someone who does’,” Reddit user @Random_Sime.

“I was studying at Swinburne and I saw Rob every day, so I gave it to him and had a little chat about 10 years ago.

“I asked him where he learned to draw and he told me that he was an artist who lived and worked at Heidi (sic)but never ‘made it’ as an artist or got excluded due to interpersonal politics.

“All he wanted to do was create art and have people appreciate it. He preferred to do reproductions of known works on the footpath rather than his own stuff because it got more attention from passers-by.

“Then I graduated and didn’t go to that area much after. RIP Rob.”

That user’s memory is the extent of what is known about Rob’s life story.

Tens of thousands of Australians facing homelessness

Rob’s was among the almost 28,000 Australians facing homelessness.

While Reddit user @Random_Sime was appreciative that so many others had come to know and love Rob’s story through his post, he reminded the community that there were many people like Rob living across Australia.

“Everyone has a story and they’re usually happy to tell it if you show a genuine interest and ask questions that lead on from what they tell you,” they said.

Rob’s final artwork has been pressure-washed from the pavement.

The only remaining markers of his life appear to be the paper printout, a lone Reddit thread and perhaps pieces of drawings collected by passing strangers.

“A kind soul has left some flowers by Rob’s spot,” the original Reddit poster said in an update.

“It’s touching to know so many people have such great memories of Rob. I truly hope he remains easy knowing his work and life of him were appreciated by so many. ”

Read related topics:melbourne

.