Shares for an Australian tech company have plunged after their earnings were 69 per cent lower than expected.

On Tuesday, Sydney-based artificial intelligence firm Appen posted its results for the first half of 2022, but that had a detrimental impact on its share price.

The company, which provides important data to tech giants around the world including Facebook, Google and Amazon, has been struggling in recent months.

According to The Australian, when its earnings were taken into account before interest, taxation, depreciation and amortization, it had made 69 per cent less than the same period the year before.

Appen generated $8.5 million in net profit over the last six months compared to $12.5 million in the same like period in 2021.

To top that off, the Aussie firm also posted a net loss of $3.8 million.

In total, it suffered a revenue drop of seven per cent to $182.9 million.

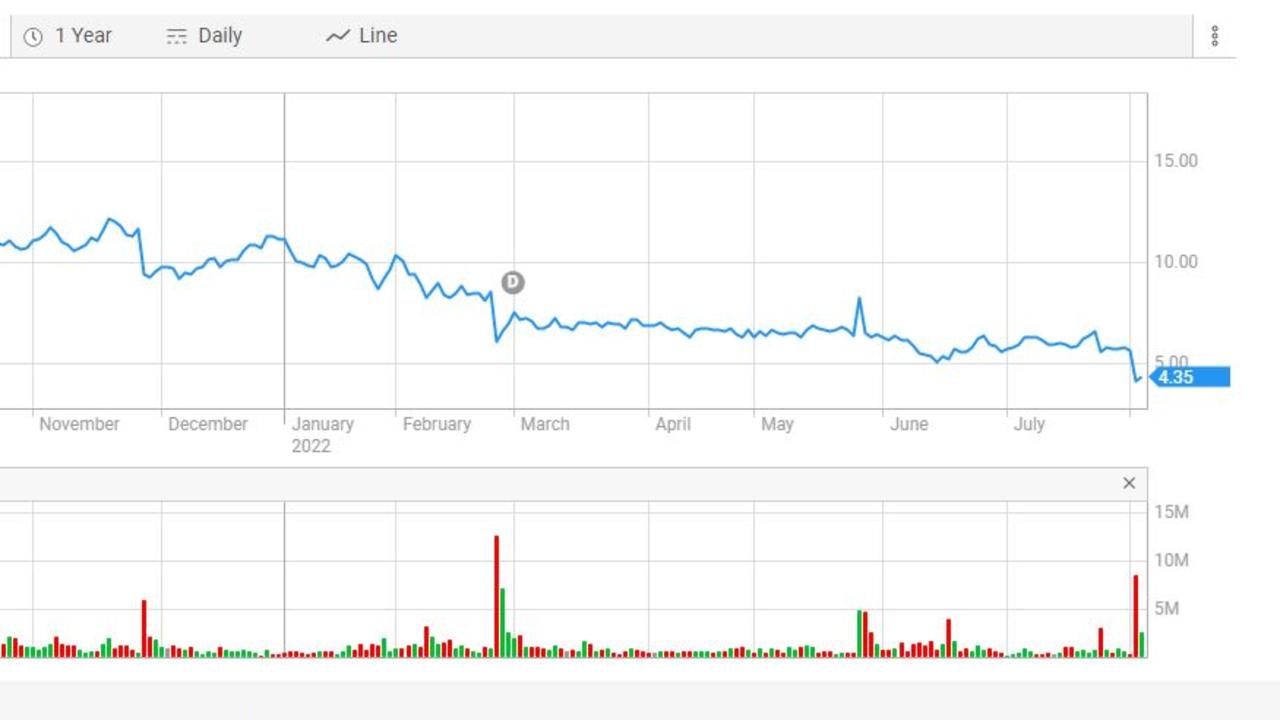

As a result, Appen’s share price dropped 27.3 per cent to $4.15 on Tuesday. At time of writing on Wednesday morning, it had recovered slightly, up by two per cent to come in at $4.24.

Appen’s CEO Mark Brayan blamed the poor performance on global market conditions as well as a weaker appetite for digital advertising.

During the earnings call, Mr Brayan said, per the Sydney Morning Herald: “With no improvement in July trading, there remains uncertainty about a continued slowdown of spending from our global customers and their exposure to weaker digital advertising demand.

“As a result, the conversion of forward orders to sales is less certain this year compared to prior years.”

Mr Brayan added in a statement to the ASX that conditions were “challenging” and that they were seeing a “flow-on effect” as customers spent less on advertising.

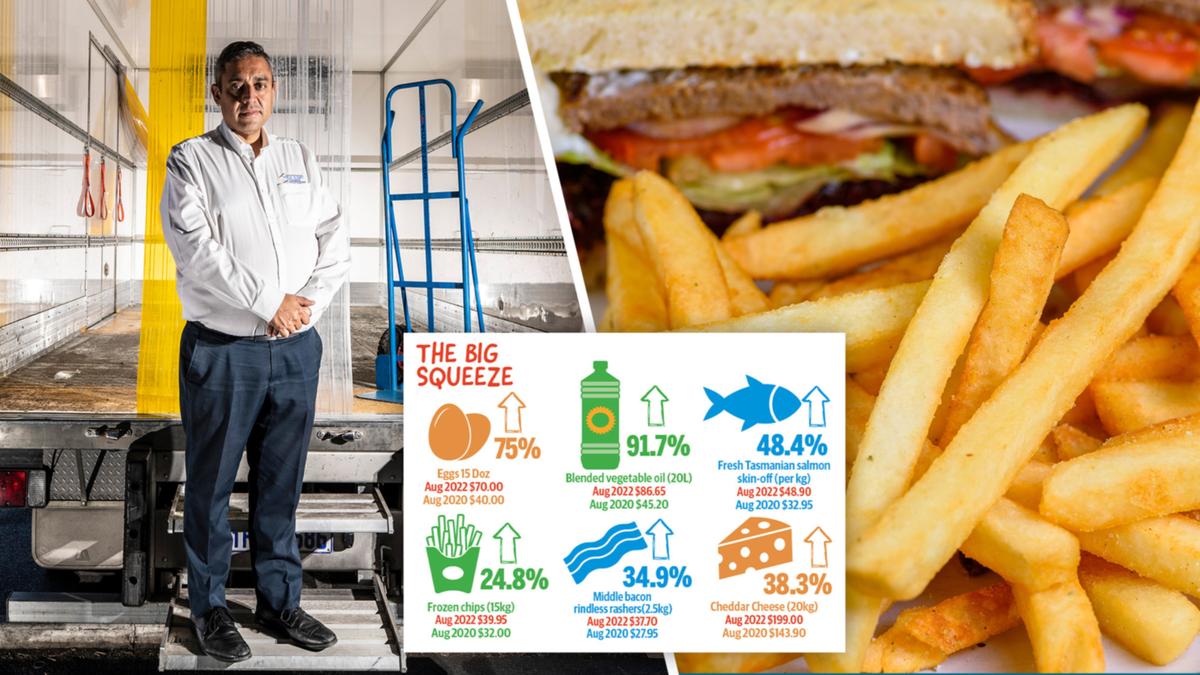

With lessening demand for their services, Appen also revealed that costs had blown out as the day to day running of the business became more expensive.

It cited investment in product and technology, heightened employee expenses, recruitment, and IT costs as another avenue where money was lost.

Like many other tech companies around the world, Appen has taken a dive, as its share price has fallen 62 per cent this year following massive gains at the height of the pandemic.

At their peak, Appen’s shares were worth around $43.50, back in August 2020. It is now trading at $4.24.

Appen first started on a downward trend in June, after its rival, Canadian IT firm Telus, scuppered a takeover deal.

The Canadian business had proposed a $9.50-per-share takeover bid for Appen, which would have made the Australian company worth $1.2 billion.

It’s unknown why Telus canned the deal.

News.com.au has contacted Appen for comment.

.