If you have been struggling to find a carton of eggs at your local supermarket, you are certainly not alone.

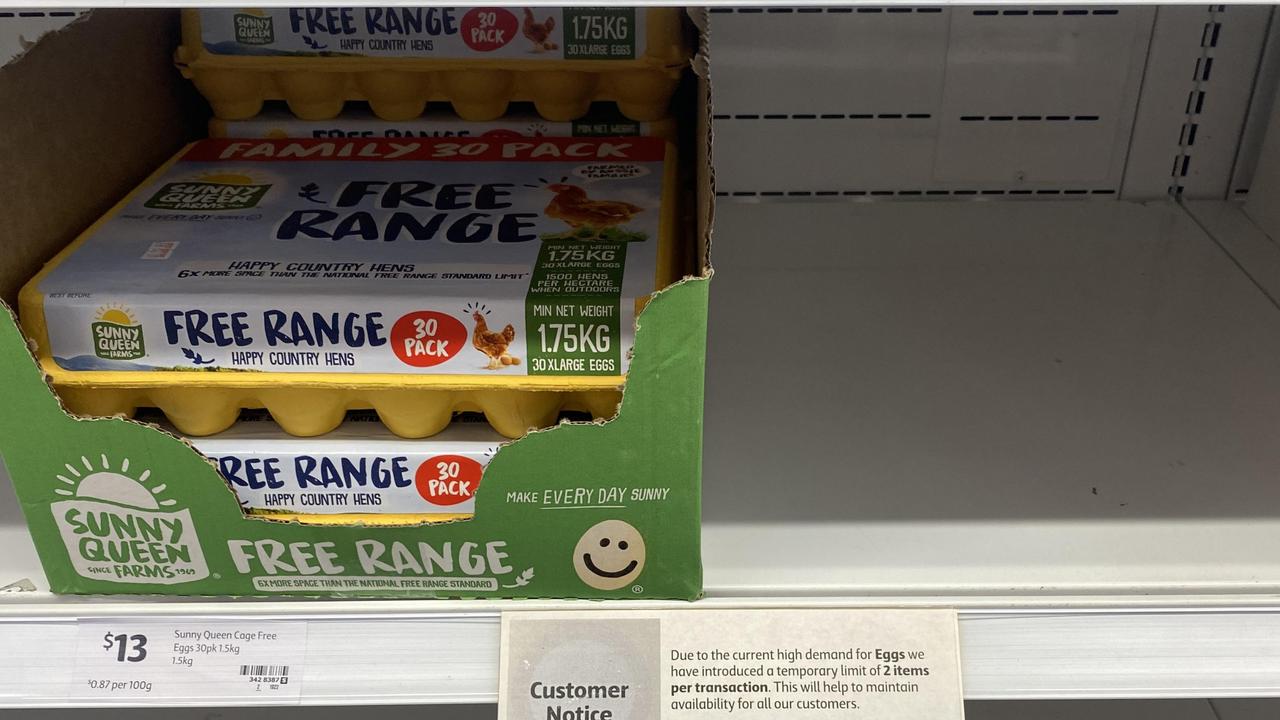

Shoppers have been left frustrated by yet another staple item disappearing from supermarket shelves, with Coles even introducing a two-carton limit for customers.

Australia is in the midst of a national egg shortage, meaning supply is patchy and prices are on the rise.

But what is behind the egg supply crisis?

Suppliers have claimed part of the problem stems from lockdowns, when farmers had to decrease their chicken numbers.

However, Edith Cowan University senior lecturer and WA president of the Australasian Supply Chain Institute (ASCI), Flavio Macau, said the shortage is a reflection of customers preferring free-range eggs over caged eggs.

The production of free-range eggs is more affected by the colder and short days of winter, I have explained in an article for The Conversation.

Sales of free-range eggs have shot up over the years, leading many farmers to invest heavily in increasing their free-range production.

“Like many agricultural industries where farmers respond to price signals and predictions, this led to overproduction, leading to lower prices and profits,” Associate Professor Macau said.

NSW’s total flock size peaked in 2017-18 but the overproduction and lower profits led to a 10 per cent drop in egg production the following year.

Then came increased compliance costs, with the Australian Competition and Consumer Commission (ACCC) in 2018 introducing rules around what is classified as free range.

Under the rules, hens need to have “meaningful and regular access” to an outdoor area during the daylight hours of their laying cycle.

“This experience has likely influenced farmers’ reluctance to increase their flocks based on predictions of higher demand,” Associate Professor Macau explained.

It isn’t only the increased land requirements that make producing free-range eggs more expensive, it is also the less consistent laying.

Unlike cage or barn hens, free-range hens don’t live in optimized conditions to stimulate laying, such as consistent temperatures and being exposed to 16 hours of light every day.

“Free-range hens are affected by hot or cold temperatures, wind and rain, and length of daylight,” Associate Professor Macau said.

“In winter months they have less energy and produce (on average) 20 per cent fewer eggs than a chicken confined indoors in controlled conditions.”

He said economic and environmental events in 2022 have made things difficult for farmers, who are facing time lags and cost pressures.

“Increasing a laying flock takes about four months. An egg takes about three weeks to hatch. Under ideal conditions, chicks need another 17 weeks before they are ready to begin laying,” he said.

“Any farmer who has begun this process in the past month will be producing more eggs by December. But then it will be summer, when they won’t need 20 per cent more hens to make up for their winter slump.”

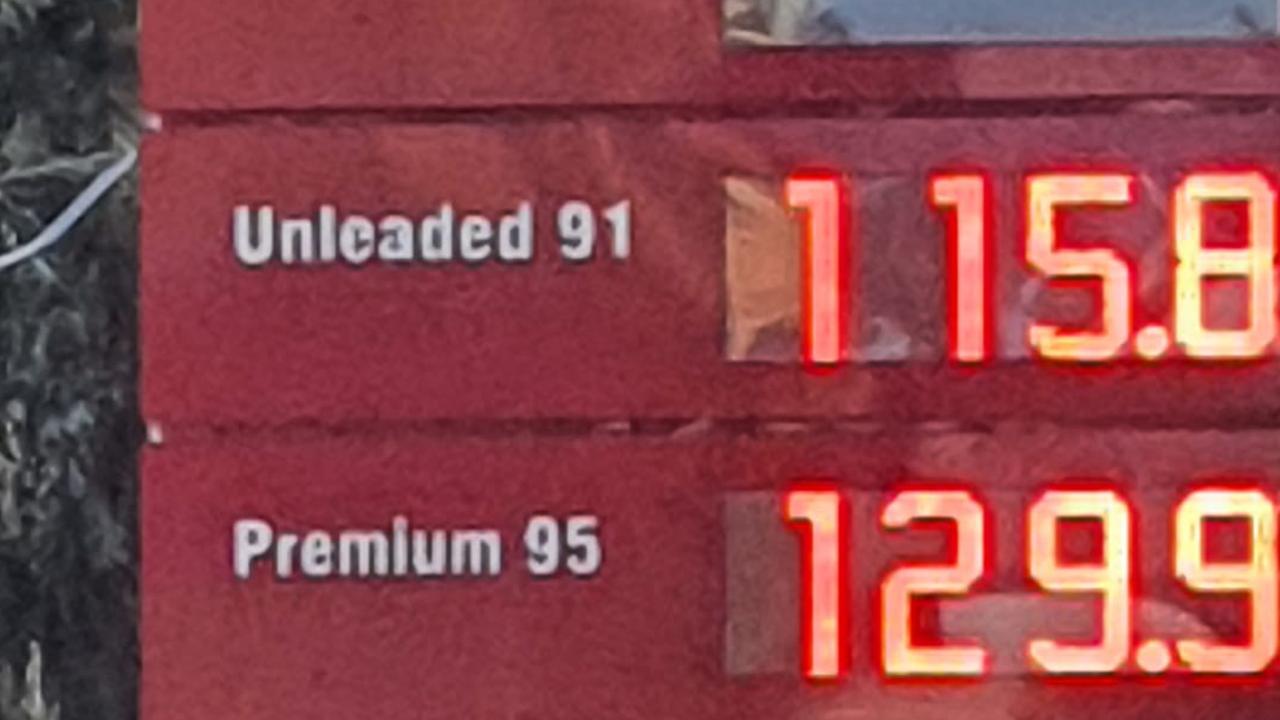

The rising cost of living also means feed, electricity and transport costs have shot up, forcing many farmers to be careful about how they conduct their business.

“It is preferable to undersupply than to go bankrupt through oversupply,” Associate Professor Macau said.

The notion of the winter slump has been backed up by farmers.

Last week Xavier Prime, owner of Chooks at the Rooke, a free-range egg farm southwest of Melbourne, told 3AW that “to lay the optimum”, hens needs 15-16 hours of daylight every day, but at the moment they are experiencing just 10-11 hours.

“Free-range eggs, in that sort of space the birds are open to the elements, and with the daylight hours being shorter, that has a lot to do with how many eggs the chickens lay,” he explained.

Associate Professor Macau said a short-term fix to the supply issues seemed “unlikely”, noting wet weather forecasts from August to October were not favorable laying conditions.

However, once the weather warms up, production should return to normal levels.

“Unless consumers are willing to pay more to ensure a constant supply in winter months, our shift to free-range eggs carries a higher likelihood of winter shortages,” he said.

“We must do what we have done through every disruption in recent times: endure, adapt and prepare for the next crisis.”

.