Both low-income suburbs and affluent neighborhoods were flagged in the report.

Paul Feeney, chief executive of Otivo, told 9news.com.au he expects another 300,000 households will fall into mortgage stress over the next 12 months if interest rates rise by another one per cent, which is widely anticipated.

“That’s when I think the pressure will really hit,” he said.

“Particularly if inflation keeps going up and wages don’t increase.”

Should Feeney’s prediction materialize, more than half of all Australian households with a mortgage would be in mortgage stress, up to 54 per cent from the current 45 per cent.

Even if households scramble to cope with the steep repayments, Feeney said the level of stress and anxiety inside countless Aussie homes will be significant.

“It is worrying,” he said.

The most vulnerable postcodes fell into “two distinct groups,” Feeney said, lower income households and higher-earning suburbs.

Feeney said he was “very surprised” to see some of Australia’s “more well-off suburbs” now under pressure, including parts of the eastern suburbs in Sydney, inner Melbourne and upscale areas of Perth.

Four-straight RBA hikes was “eating” into people’s surplus savings, he said.

For many, wages have remained static or gone backwards because of rising inflation.

“That’s why we’re seeing… the number of those in mortgage stress increasing.”

For a borrower with a $500,000 loan, the latest RBA decision meant a monthly repayment increase of $140, or an additional $472 every month since the RBA began lifting rates in May.

After August’s announcement, a person with a $750,000 loan is paying an extra $211 each month, up $708 since May.

Those with a $1 million mortgage are paying $281 more each month, which equates to an eye-watering $944 increase.

For its report, which surveyed the cashflows of 52,000 households nationally, Otivo highlighted three postcodes in each capital city set to feel the biggest impact from the most recent RBA announcement.

Otivo defines a household being in mortgage stress when its monthly surplus is reduced to zero or runs into negative because of increased mortgage repayments.

The top three postcodes are highlighted below.

In Sydney, some parts of the city’s eastern suburbs who have traditionally had very few households with mortgage stress will now begin to feel the heat of interest rate rises.

Suburbs like Chifley, Eastgardens, Hillsdale, La Perouse, Little Bay, Malabar, Matraville, Phillip Bay, Port Botany have gone from 0 per cent mortgage stress to 43 per cent in mortgage stress, the report said.

In Melbourne, the report projected suburbs in the inner-south will be hit hardest.

Many of those suburbs have never suffered mortgage stress, but they will now begin to feel financial pressure over the next 12 months, the report concluded.

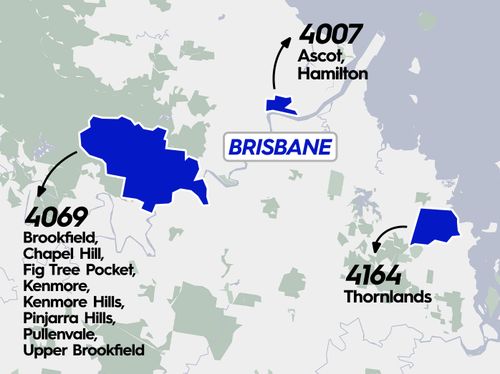

In Brisbane, suburbs in Ipswich including Brookfield, Chapel Hill, Fig Tree Pocket, Kenmore, Kenmore Hills, Pinjarra Hills, Pullenvale, Upper Brookfield face mortgage challenges.

The latest RBA hike has led to almost 52 per cent of households in these suburbs falling into mortgage stress, according to the Otivo report

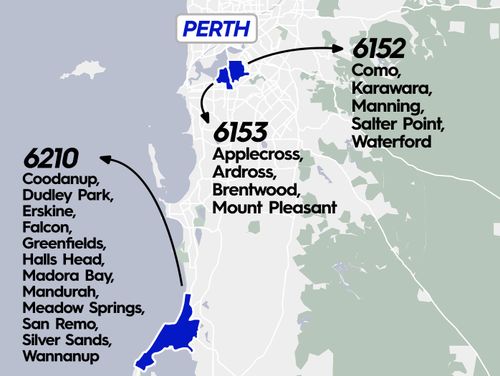

Some of Perth’s most affluent suburbs in the prestigious south-west will soon be hit with mortgage stress, the report warned.

Almost 59 per cent of households in postcode 6153 (Applecross, Ardross, Brentwood, Mount Pleasant) will be buffeted by the most recent RBA interest rate announcement.

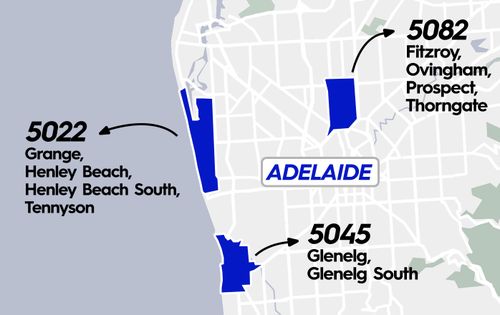

In Adelaide, postcodes in the west are set to suffer with rising monthly repayments, because of recent RBA decisions.

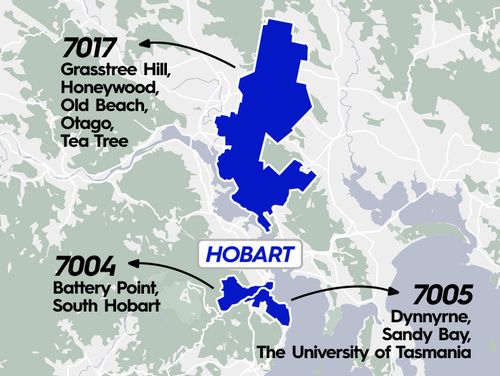

The three post codes worst affected in Hobart lie in the city’s north and central neighbourhoods.