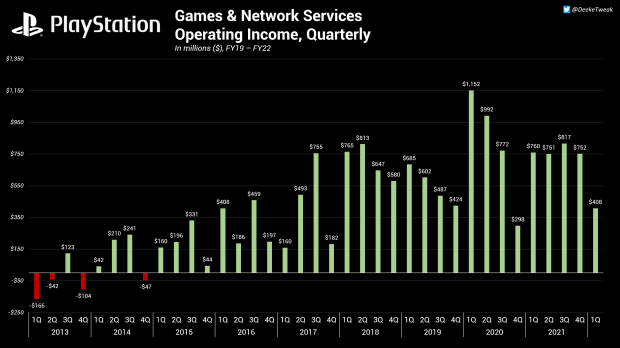

PlayStation division operating income has been nearly cut in half due to unfavorable market conditions and increased game development spending.

VIEW GALLERY – 10 PICTURES

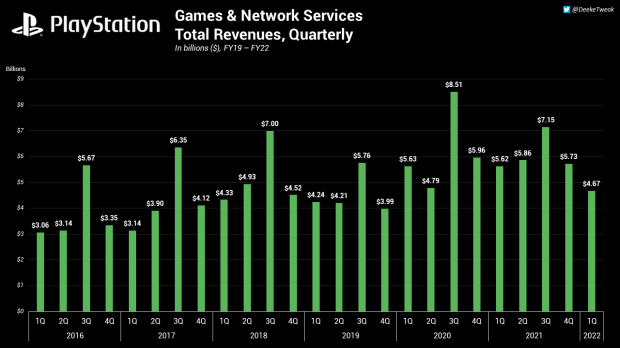

Sony’s recent Fiscal Year Q1’22 results show sharp declines in its billion-dollar gaming segment and highlight the tumultuous market that could inhibit consistent growth. Games & Network Services, which includes the mighty PlayStation brand, saw substantial drops in both total sales revenues when converted from yen to USD based on foreign exchange market rates provided by the company.

According to the data, PlayStation net sales revenues dropped to $4.67 billion in Q1’22, a decline of $890 million or 17% year-over-year.

Operating income in Q1’22 was $408 million, representing a year-over-year drop of $52 million or 46%.

There’s multiple causes for these drops. Tough competition from the previous year is a big one. as we explained with Capcom’s results, which also dropped by 50%, Sony had set a high water mark in FY20 and FY21 due to coronavirus spending boons as consumers sheltered in place, alongside more favorable conversion rates. Consumers are also being hit with inflation and are apparently spending less money on–and in–video games.

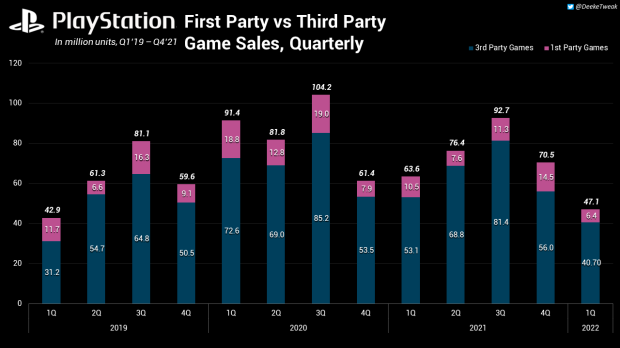

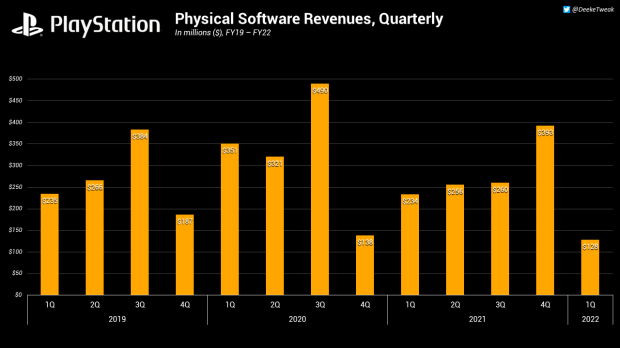

Sony says that first-party and third-party game sales declined in Q1’22, as reflected by the hard data provided by the company. First-party games were down 4.1 million units, and third-party games were down 12.4 million units.

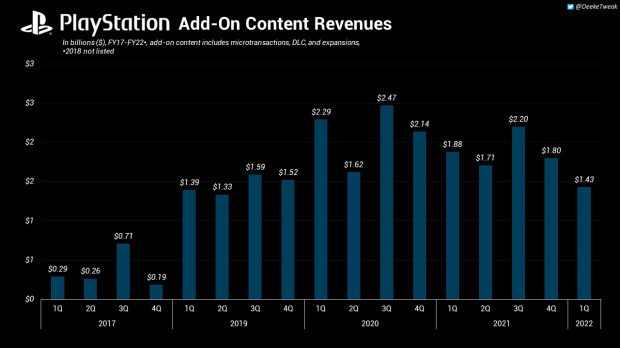

Microtransaction spending in PlayStation’s Add-Ons segment was also down by nearly half a billion dollars year-over-year. Add-Ons make the lion’s share of PlayStation revenues every quarter/year due to the sheer volume of microtransaction spending opportunities in heavy-hitting, mega-popular F2P games like Fortnite, Apex Legends, and Warzone.

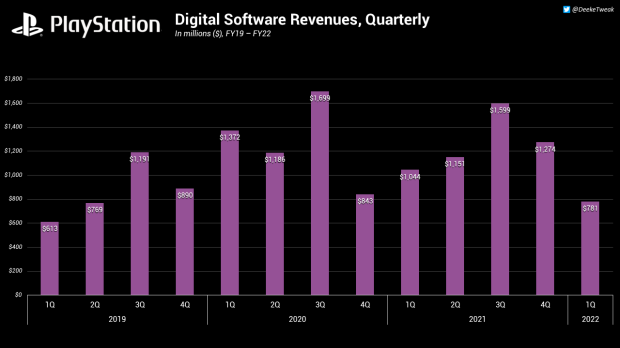

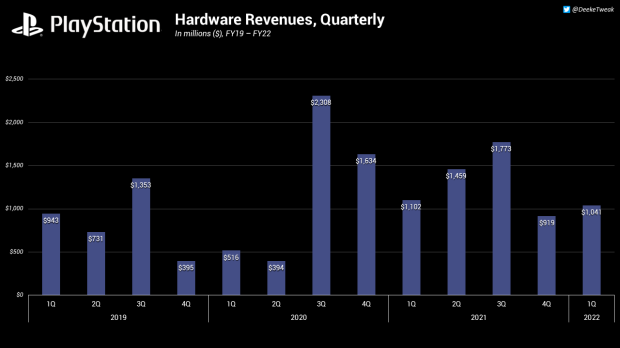

Revenue from video game sales and add-on content has also dropped 27% to $2.33 billion, but hardware sales are up 13% year-over-year to $1.04 billion, reflecting the strong adoption rate of the PlayStation 5 as well as Sony’s improved profit margins on each console sold.

Unfavorable exchange rates have primarily affected PlayStation’s USD conversions. Yen to USD exchange rates went from 109.5 in Q1’21 to a whopping 129.4 in Q1’22, representing 18% increase in USD value when compared to yen. The US dollar has more buying power in Japan during the comparative period.

Sony is also spending more money on games development and acquisitions. The company is readying a bunch of live games and wants to release 12 live service titles by 2025. It also recently purchased Haven, a new studio led by Assassin’s Creed vet Jade Raymond, and Bungie, the developer of Destiny and legacy Halo games.

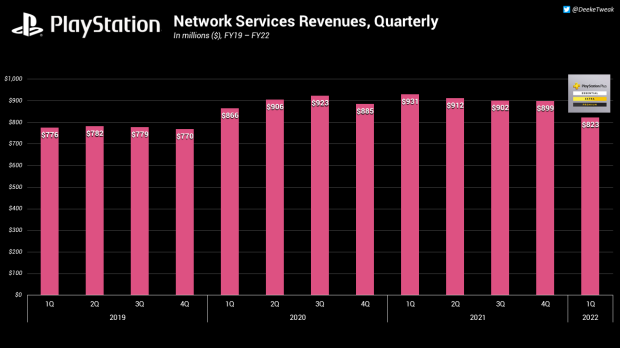

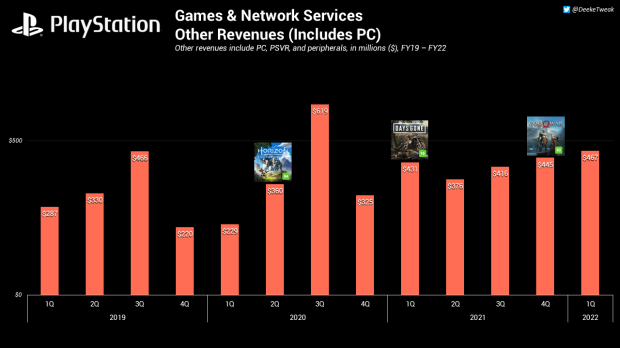

Below we also have data on Sony’s growing Other segment, which includes PC game revenues, and Network Services, which includes PlayStation Plus.

.